China may power a quarter of global GDP by 2030

China to become the world's largest insurance market by the mid-2030s

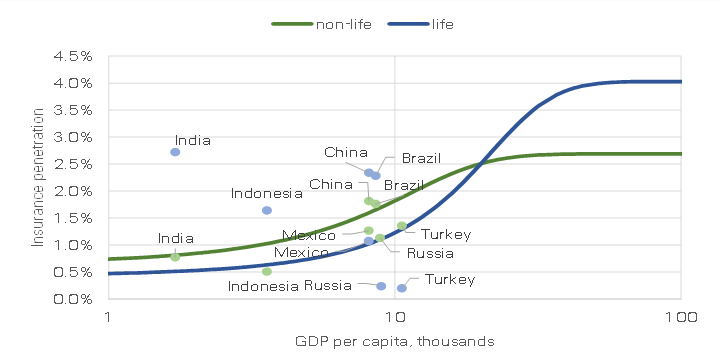

As insurance demand has a strong positive relationship with economic growth, we forecast that emerging market premiums will more than double over the next 10 years from $1.1 trillion in 2018 to $2.9 trillion in 2028, outpacing advanced market premium growth. This is also supported by the S-curve analysis, which suggests that when GDP per capita reaches the magic number of 33,500 yuan ($5,000), insurance market growth will accelerate, reflecting the rise of an economy's middle class.

In particular, we forecast China will surpass the United States to become the world’s largest insurance market by the mid-2030s. The country’s GDP per capita growth has increased at a five-year CAGR of 8.2 percent, and more than a third of provinces reached above 63,740 yuan ($9,500) in 2018 – an income level associated with high income elasticity of insurance demand.

2016 S-curve, EM7 countries

Source: Insurance regulators, Swiss Re Institute

The Belt and Road Initiative (BRI) is another factor affecting the Chinese insurance market. The initiative is expected to generate a total investment of around 50 trillion yuan ($7.4 trillion), of which more than 80 percent is expected to be in infrastructure. Substantial investment will boost insurance demand. We estimate that the total premium potential from BRI-associated construction activities could reach 228 billion yuan ($34 billion) in 2015-2030, the majority of which will be booked to insurers in China. Currently the total annual premium in global engineering insurance is 140 billion yuan ($21 billion), of which only 10 billion yuan ($1.5 billion) was written in China. In addition to the direct premiums generated, there are significant opportunities for insurers to invest in BRI projects themselves.

Against these backdrops, I am very optimistic about the development of the Chinese insurance market. We forecast that premiums in China will grow three times faster than the global average over the next decade and that the country will become the biggest insurance market in 15 years.

The author is group chief economist for Swiss Re and managing editor of Sigma, responsible for economic and insurance market research. He is particularly active in external committees and roundtable discussions with policymakers in strengthening the positive dual role of the insurance sector as a long-term investor and risk absorber.

The opinions expressed here are those of the writer and do not necessarily represent the views of China Daily and China Daily website.