Plans drafted for small, medium-sized banks to replenish funds

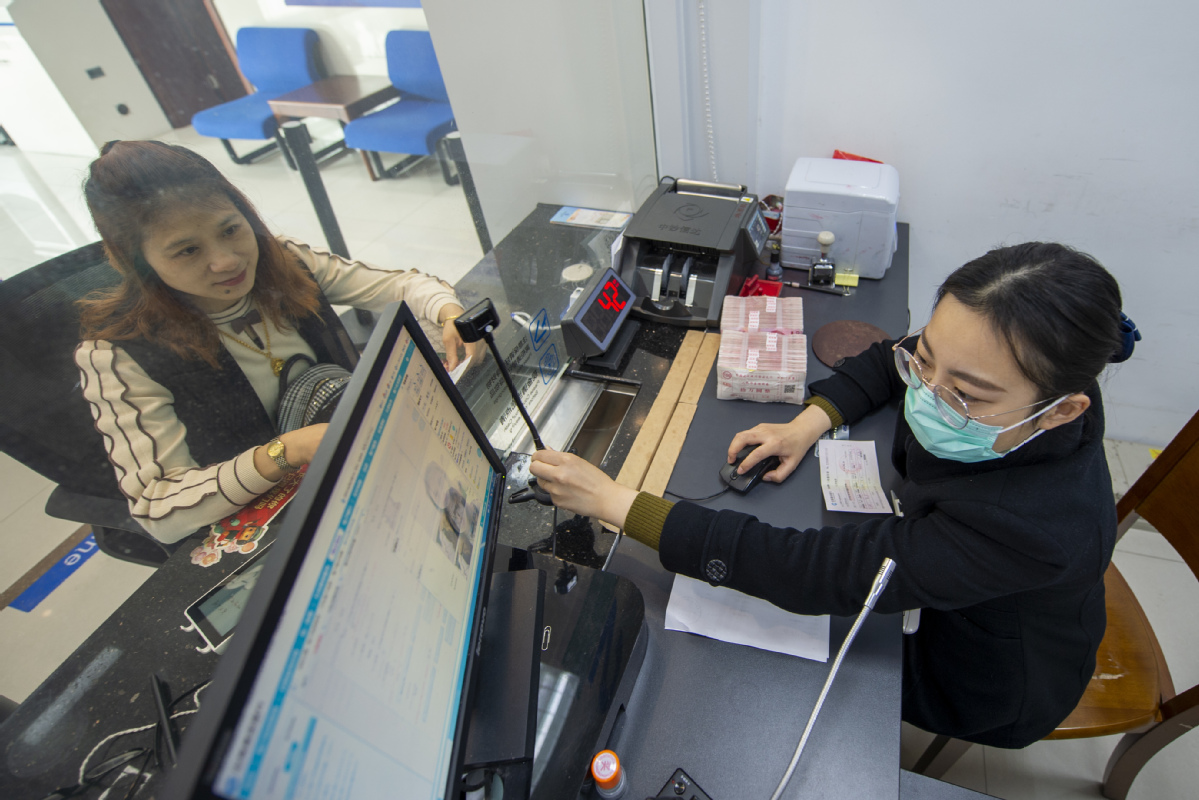

Some provincial governments are drafting plans to deepen reforms of small and medium-sized banks so they can replenish their capital, improve their ability to combat risk and serve the real economy.

The China Banking and Insurance Regulatory Commission (CBIRC) distributed a work plan earlier this year together with several other government departments to encourage local governments to raise funds in accordance with laws and regulations to participate in capital replenishment and risk mitigation of small and medium-sized banks.

It also urged these banks to make full use of market-oriented financing channels to replenish their capital.

China will allow local governments to issue up to 200 billion yuan ($28.6 billion) of special-purpose bonds to purchase convertible bonds and other qualified capital instruments of small and medium-sized banks in 18 regions, said Liu Rong, deputy director of the CBIRC's city commercial bank supervision department.

"Strict procedures and conditions must be followed for the use of local government special bonds," Liu said on Thursday.

"Provincial governments will make decisions on the size of special bonds to be issued to help small and medium-sized banks replenish capital, under the premise that verifications of banks' assets and capital are conducted, the original shareholders have undertaken the corresponding responsibility, the exit mechanism of the investment has been made clear, and the repayment is ensured," the official said.

Local governments in some provinces and cities have already started doing research on how to use the money, he added.

"Currently, the overall operation of China's banking and insurance sectors remains stable, and financial risks faced by them are generally under control. Although risks are quite high for some banking and insurance institutions, they will not affect the stability of the entire industry, as there is only a small number of them," said Xiao Yuanqi, chief risk officer and spokesperson of the CBIRC.

The regulator's efforts to crack down on shadow banking and rectify market irregularities since 2017 also allowed room for risk containment during the COVID-19 epidemic, Xiao said.

By the end of June, major regulatory indicators of China's city and rural commercial banks stayed within a reasonable range. For 134 commercial banks that were running normally, their nonperforming loan ratio was 2.34 percent, down 0.1 percentage point from the beginning of this year.

Their provision coverage ratio fell 0.92 percentage point to 150.5 percent during the same period, and their capital adequacy ratio dropped 0.05 percentage point from the beginning of this year to 12.65 percent at the end of the first quarter.

"Many city commercial banks have optimized their business structures step by step, which could be seen from an increase in the proportion of their lending business to total business and a decline in their high-risk shadow banking business," Liu said.

However, financial risks still kept emerging at city commercial banks in recent years as the banks were affected by the domestic and world economic situation, along with their own levels of management and corporate governance, he said.

"City and rural commercial banks are targeting smaller clients with higher risks. Their level of comprehensive management is weaker than that of large banks, and they did not make accurate asset classification in the past based on risk exposure," Zhang Naixin, deputy director of bank ratings at China Chengxin International Credit Rating Co, said in an online conference on Thursday.

Li Yan, a banking analyst at Moody's Investors Service, said the asset quality pressure brought about by small business loans is mainly concentrated in small regional banks.