Rising inflation in US poses growing global risk

The latest data from the US Department of Labor shows that the country's consumer price index rose by 7.5 percent from February 2021 to January 2022, higher than the previously anticipated 7.3 percent.

Even without taking food and energy prices into consideration, the so-called core CPI in the United States had risen by 6 percent, the highest since August 1982.

Although the Federal Reserve officials claimed more than once in 2021 that the inflation would be "temporary" and would ease with the reopening of the economy, that has proven not to be the case.

In a modern society, the damage inflation could do to ordinary people's lives needs no stressing. With the prices of gas and food rising sharply, the cost of living is increasing. Economists at the University of Pennsylvania estimate that the average US household is spending $3,500 more than in 2020 to buy a basket of the same goods and services.

Moody's economists even estimate that each US family must spend $250 more a month because of the inflation, of which those between 35 and 54 need to spend $303 to $305 more.

That means many might face difficulties in the event of something unforeseen happening, since data from the Fed indicates that 36 percent of Americans do not have the ability to pay $400 should there be an emergency.

US President Joe Biden has said that his administration will win the battle against inflation and everybody knows that his administration is likely to ask the Fed to increase interest rates, with expectations that there will be six to seven interest rate hikes this year.

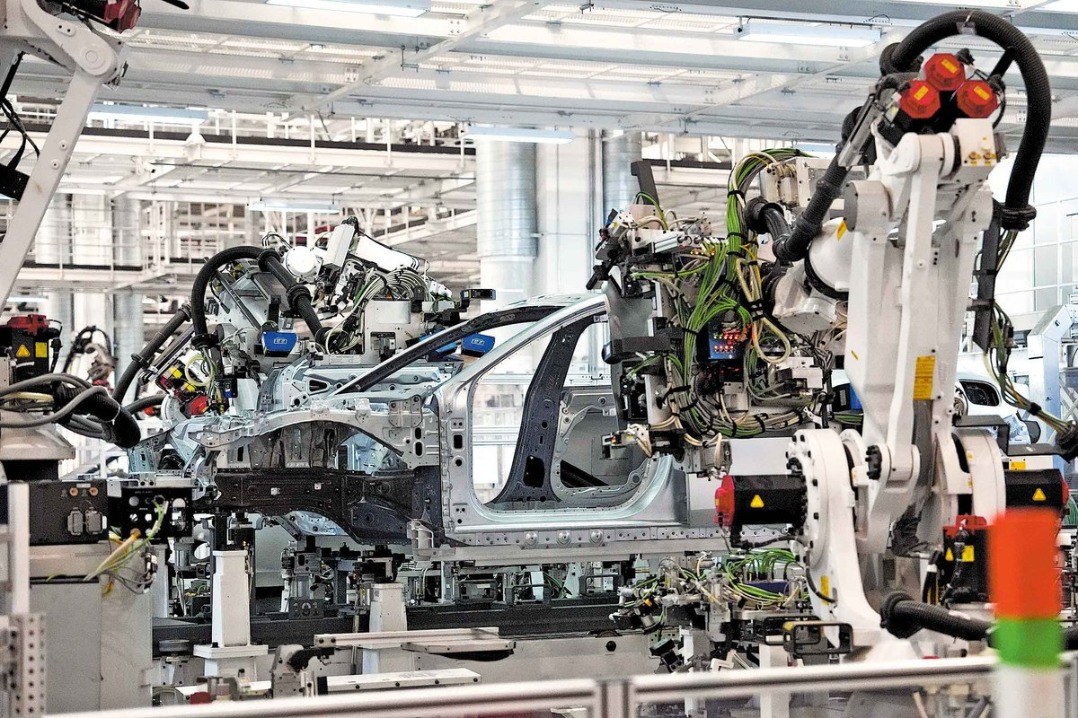

Yet raising interest rates is like a sieve, sifting out those entities (and the people who work in them) whose profit margins are not high enough. After the tightening of investment, high-profit entities are left, and they need skilled workers.

The people who have left the labor market during the epidemic are mainly those workers who are afraid of contracting the virus and have retired early or have started their own businesses. The former are unlikely to return to the labor market in the wave of interest rate hikes, while the latter are the object of continued elimination by interest rate hikes.

This means that supply after the interest rate hikes may still not keep up, and the demand will have greater rigidity under the increasing pressure on people's livelihoods. The risk of US inflation stagnating at the same time is emerging. What all this means is the only way for the Fed to get inflation under control is to engineer a sharp slowdown in the economy. Other countries, especially the G20 members, should prepare policies in advance so as to manage the global risks.