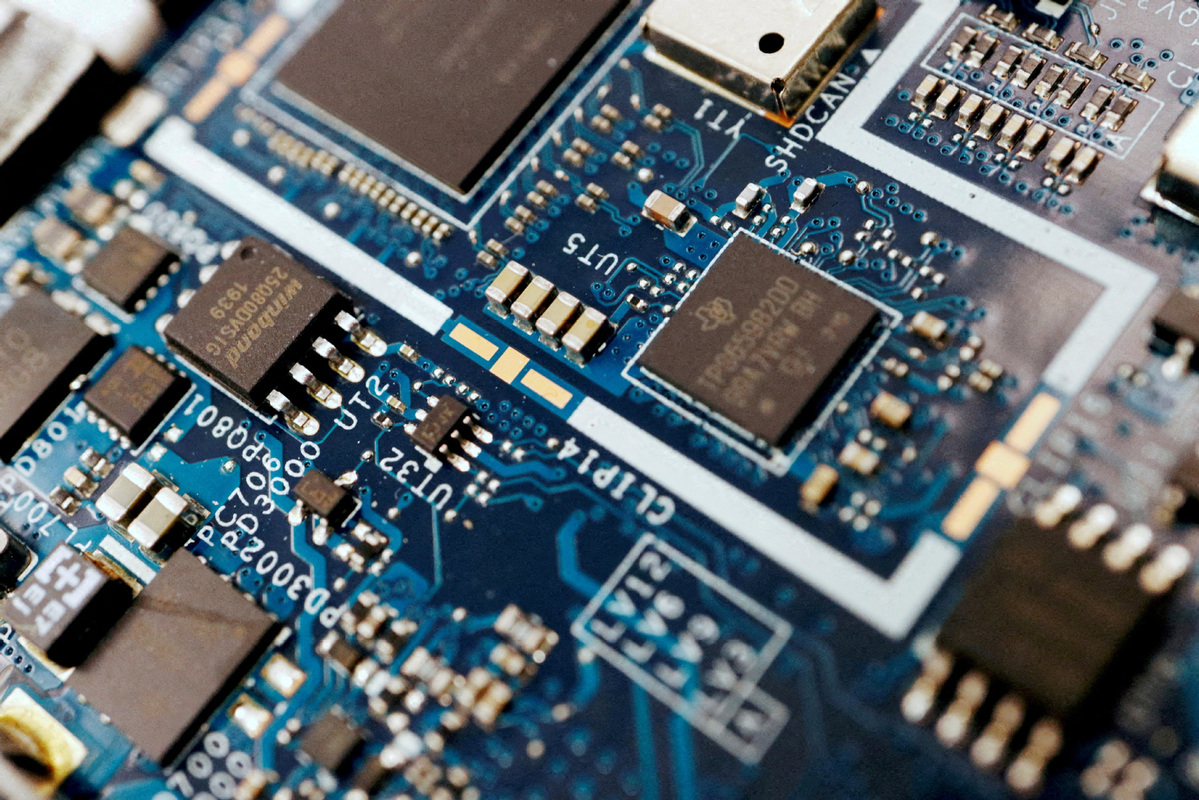

Chip sector innovation seen as confidence boost

With unchanged confidence in China's ongoing technology upgrading and the potential implied in its massive market size, European high-end printed circuit boards and integrated circuit substrates provider AT&S Group will continue production localization and technology innovation in the country, said the company's top executive.

Zhu Jinping, chairman of the board of directors at AT&S China, commented at a recent news conference held in Shanghai that the trade conflict between China and the United States will exert no direct impact on AT&S Group's businesses at present. However, the possible impact on its end clients' businesses and the stability of their supply chains were more of a concern, he said.

Amid rising market discussions on the "China plus one" strategy, AT&S has not seen its production in China affected by the tariff issue, thanks to its manufacturing bases built in China, Malaysia and Austria, its headquarters over the past few years, said Zhu.

The strong resilience demonstrated by Chinese companies amid the geopolitical tensions and market volatility in recent years has translated into unchanged confidence for AT&S in terms of continuing its investment in the Chinese market, he added.

As Zhu understands, increasing self-reliance and self-dependence of the Chinese semiconductor industry is an inevitable trend. While external factors may have somehow catalyzed the process, the trend is more a result of China's own technology advancement.

This can be reflected by the deeper cooperation that AT&S has sought with Chinese companies in terms of high-end packaging, material research and development, as well as reliability tests.

Therefore, there is much room for growth for AT&S in China as it sticks to its "local for local" strategy. The company will continue its investment in China to roll out new products and technologies, build smart factories and complete the transformation of green factories, he added.

While the world semiconductor market saw its value surge 17 percent year-on-year to $620.21 billion in 2024, China reported faster annual growth of 20.1 percent last year, according to World Integrated Circuit Association. The Chinese mainland remained as the largest single semiconductor market in the world, with its market value reaching $186.5 billion last year.

Anticipating the world semiconductor market to grow by 13.2 percent this year, WICA also forecasts that the competition between the United States and China in the field of artificial intelligence will persist, further boosting semiconductor market applications.

Embedding technology, which puts chips into printed circuit boards, will be one major area of technology development within AT&S.

Saving space is one advantage of the technology, which makes it applicable for wearables such as AI-powered glasses and earphones. As embedding technology also helps to save energy, AT&S will promote the technology in China by using it as power management solutions for large servers and electric vehicles, according to Zhu.

Meanwhile, AT&S is positive on the growth prospect of optical transceivers in China. Therefore, the company has established production capacity at its Shanghai and Chongqing facilities to serve Chinese clients, he said.

Founded in 1987, AT&S saw its consolidated sales revenue reach 1.59 billion euros ($1.81 billion) for fiscal year 2024/25 ended March 31, 2025, up 3 percent from the prior-year period. Excluding the possible impact of an escalated trade dispute, AT&S is currently forecasting revenue of 2.1-2.4 billion euros for the financial year 2026/27.

With operations built in Shanghai and Chongqing, AT&S now hires about 8,800 people in China since establishing its first footprint in the country 24 years ago.

Shanghai, alongside its global headquarters in Leoben, Austria, plays a key role in research and development within the AT&S Group, according to the company's public information.