Industrial Effect of a China-Japan- Korea FTA: Cross-sector Analysis

2005-09-01

Zhang Xiaoji, Zhang Qi, Zhang Liping& Xu Hongqiang

I. New progress in intra-regional trade and investments of China, Japan, and Korea

Over the past year, China, Japan, and Korea all maintained good economic growth, and created a new situation of healthy interaction through bilateral trade and investment.

1. Intra-regional trade

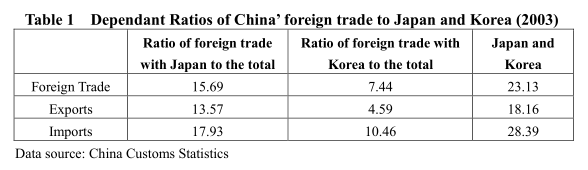

China, Japan, and Korea are all big trading powers. The commodity trade of the three countries contributed 14.2% to the world’s trade in 2003. Trade between China, Japan and Korea maintained rapid growth, at a rate higher than global trade. The intra-regional trade has continuously expanded, up to 24% of the three countries’ total foreign trade in 2003. However, the growth of intra-regional trade was attributed to the rapid increase in the exports of Japan and Korea to China. In other words, the robust intra-regional trade was driven by China’s dramatically expanded domestic demand.Japan and Korea are China’s major export destinations and import sources (See Table 1). In 2003, China’s exports to Japan and Korea ranked the fourth and sixth of all its export destinations. Meanwhile imports from Japan and Korea ranked first and fifth of China’s import sources. China’s foreign trade is more dependent on imports from Japan and Korea than exports to them.

2. Bilateral investment

Foreign direct investment (FDI) is crucial to division of labor and industrial layout in Northeast Asia. Among the three countries, Japan is a capital provider, China is a capital receiver, and Korea is a capital receiver from Japan and a provider to China. The intra-regional investment made up 8.4% of the total in the region in 2003, up slightly over the previous year. For China, Japan is its third largest investment source, with a total investment of USD 16.5 billion over the past four years. Korea ranked first among all of China’s investment sources in terms of investment growth rate. Its investment in China amounted to USD 10.6 billion in the past four years. According to Korean statistics, the investment from Japan reached USD 5.16 billion in 2000-2003, accounting for 12.3% of Korea’s total FDI inflow, much higher than only 1.1% from China. Japan was the second largest investment source of Korea. FDI to China from Japan and Korea is a critical determinantfactor for the division of labor and industrial layout in Northeast Asia.

Of all foreign investment in China, 70% is concentrated in the manufacturing sector. Among the investment of Japan and Korea to China, 79% and 87% flowed to the manufacturing sector respectively. The textile and clothing industry used to be favored by investors from Japan and Korea. In recent years, however, Japanese and Korea’s enterprises have been more inclined to invest in electronics and telecommunication equipment, transportation equipment, electric machinery, and general equipment industries. Investments in these fields and its proportion in total manufacturing investment both increased drastically.

3. Relationship between trade and investment

The selection of industry and region for foreign direct investment has a significant impact on the intra-regional trade and trade with other regions. For instance, Japan and Korea conducted industrial transfer to China through FDI. That did not impair their position as strong manufacturing countries, but expanded their exports to China. Meanwhile, foreign-invested enterprises (FIEs) have occupied a share of over 50% in China’s trade with Japan and Korea[1], and Japanese- and Korean FIEs play a dominant role. It is evident that the promotion effect that FDI exerts on China’s bilateral trade with Japan and Korea is much higher than the substitution effect.

FDI also plays a crucial role in maintaining trade balance between within and outside East Asia.

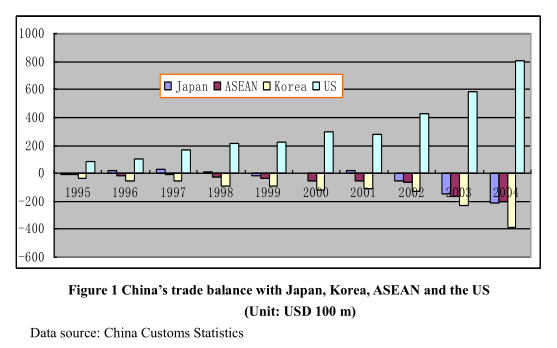

On account of China’s down-stream position in East Asia’s production chain, many countries tend to move more and more goods to China for processing export. Transfer trade has led to increasingly expanded deficits in China’s trade with Japan, Korea and ASEAN (See Figure 1). In contrast, China’s trade surplus with the US is expanding. Transfer trade has become one of the major factors causing trade friction between China and the US.

…

If you need the full text, please leave a message on the website.

--------------------------------------------------------------------------------

[1]Under the processing trade, FIEs contribute up to 77% of China’s trade with Japan and South Korea.